Last Updated on April 24, 2024

A Type 1 Diabetic’s Guide to Getting Life Insurance

Whether it seems fair or not, Type 1 diabetics have a challenging time obtaining life insurance. And, those that manage to score a policy often find that it is not the most affordable insurance to maintain. Life insurance for Type 1 Diabetics isn’t as easy as simply picking one company, applying, and hoping for the ‘best’.

According to the JDRF, here are some Type 1 Diabetes statistics:

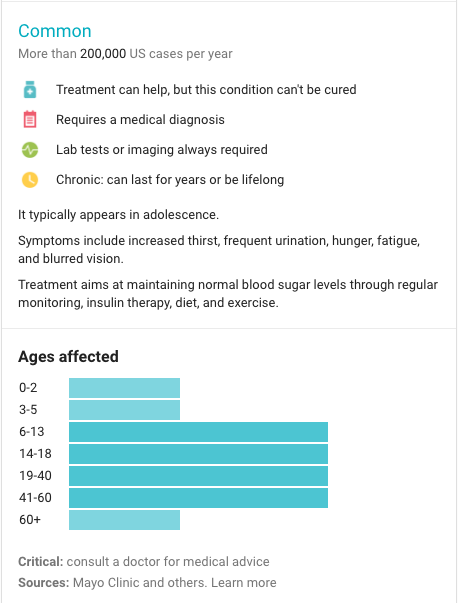

- Some 1.25 million Americans are living with T1D, including about 200,000 youth (less than 20 years old) and more than 1 million adults (20 years old and older).

- 40,000 people are diagnosed each year in the U.S.

- 5 million people in the U.S. are expected to have T1D by 2050, including nearly 600,000 youth.

- Between 2001 and 2009, there was a 21 percent increase in the prevalence of T1D in people under age 20.3

- In the U.S., there are $14 billion in T1D-associated healthcare expenditures and lost income annually.

- Less than one-third of people with T1D in the U.S. are consistently achieving target blood-glucose control levels.

Certain life insurance carriers still view the Type 1 Diabetes community as a higher risk. In reality, many people who have Type 1 Diabetes are in better overall health, compared to a person who doesn’t have Type 1 Diabetes.

Having Type 1 Diabetes means you are watching everything you put into your body. Not to mention you are constantly checking your blood sugar, and seeing your Endocrinologist quarterly. You can argue that people with Diabetes see their Doctors more frequently then people with any other type of Chronic illness.

If you are a diabetic, then you know this struggle all too well. You’ve heard the rumors that you can’t obtain an affordable Diabetic life insurance policy. But those are just rumors. Work with an agency such as Diabetes 365 who ONLY works with the Diabetes community. Because of our relationships with life insurance carriers, we have access to proprietary underwriting guidelines, that help our clients obtain the most affordable life insurance coverage.

Thankfully, there is a way to obtain Type 1 Diabetes life insurance that is affordable – regardless of your diabetes diagnosis. This is where we come in to save the day! Our agents will help you navigate the Type 1 Diabetic Life Insurance market place! Contact us today, and find out what your life insurance options are!

I Have Type 1 Diabetes. Can I Even Obtain Life Insurance?

Most likely, yes, you can qualify for life insurance coverage, with Type 1 Diabetes. And the premiums may be lower than you initially thought. Everyone’s health profile is different, so it’s impossible to immediately say you’ll qualify for coverage.

Risk. That is what it all boils down to. If you have been diagnosed with Type 1 diabetes, you are viewed as a greater risk to insurance companies compared to someone who does not have the condition. While having diabetes does not automatically disqualify you for coverage, the long-term effects it can bring is what becomes such a deterrent.

Type 1 Diabetes can be well-managed, but it can eventually lead to heart disease, blindness, high blood pressure, stroke, and even kidney failure. This is why you will find the condition listed as high risk with many insurance carriers. But not all companies view Type 1 Diabetes the same. Certain life insurance carriers view your condition more favorably than others.

Good news! Many life insurance policies will have to go through underwriting. In doing so, they are able to take a deeper look at your medical profile and make a determination based on your overall health. This means that those with diabetes are not automatically refused coverage. Instead, the underwriter reviews your details surrounding the condition. The better your overall health profile looks, the lower Diabetes life insurance premiums you’ll pay. Also, the more options you’d have in terms of the various insurance companies, who would consider for coverage.

What Do Underwriters Look for in My Diabetes History?

Simply put, underwriters are looking to make sure that your diabetes is at a minimum, under average control. If your Diabetes is considered well managed, then that’s even better! This will lead to more companies willing to offer coverage, and lower premiums.

After all, there is a huge difference in risk when it comes to managing – and not managing – your Type 1 Diabetes diagnosis. But that is not all they look it. Underwriters try to form an overall picture of the applicant based on many factors. For Type 1 Diabetics, they focus on a few key areas:

+ Age of Type 1 Diabetes Onset

Life Insurance companies will want to know the age you are now (when you submit your application), as well as the age you were when you were diagnosed with diabetes. This lets them know where you are in the condition and how well you have or haven’t maintained it.

Of course, the longer you have had diabetes, the riskier you will appear to the underwriter of most companies.

HOWEVER, some life insurance companies could care less about the age you were diagnosed with Diabetes. But rather they are worried about the level of control you are showing. This is why it’s important to work with agents who are proficient in Type 1 Diabetes Life Insurance.

Life insurance is available to people of all ages with Type 1 Diabetes. Children with Type 1 Diabetes can even qualify for life insurance coverage, at a young age.

+ Any Type of Diabetes Complications?

As you know, complications can occur at any age, due to Diabetes. Common complications include Retinopathy, Neuropathy, and Nephropathy. Having a Diabetes complication along with having Type 1 Diabetes will eliminate several life insurance companies to choose from. However, depending on your overall health profile, certain companies may consider for coverage.

The life insurance companies that will consider you will offer policies, that are ‘table rated’. Meaning your policy will have higher premiums compared to Type 1 Diabetics who do not have any complications.

In some situations, perhaps you had surgery for Retinopathy in the past. And no further issues have come up. In this situation, some companies wouldn’t be concerned, and wouldn’t rate you higher.

Having a Diabetes complication does not necessarily mean you won’t qualify for Type 1 Diabetes Life Insurance, but it may mean your options will be more limited. Or possibly higher priced.

After you obtain a Type 1 Diabetes life insurance policy, and your health changes, you don’t have to worry about rates increasing. Companies base their offers off your health profile at the time of application.

+ Your A1C levels

Life Insurance Underwriters want to know just how severe your diabetes condition is. The more severe they find it to be, the riskier you become to the insurance company. Various companies all have different guidelines when it comes to an A1C history. This is why it’s important to work with agencies such as us, to find the best priced options.

When it comes to A1C levels, underwriters generally break it down like this:

6.0 – 7.5: This A1C level is not viewed as severe at all. In fact, if this is what your underwriter finds, you will likely notice much difference in premiums at all. Certain companies will offer better rates to people with A1C readings in this range.

7.5 – 8.5: A1C levels that fall within this range generally do not spark concern. Depending on other factors, levels within this range could be viewed as having AVERAGE control of your Diabetes. Companies won’t raise your rates, and you’ll certainly have several options assuming no other major health issues.

8.6 and above: To some life insurance companies, they will start to be concerned and wonder, why your A1C is elevated. For some Type 1 Diabetics, you can do everything right, follow Doctors orders, and your levels may not be able to get to where you want them. If this is the case, please let us know as there are life insurance companies who understand all of this, and won’t penalize your Type 1 Diabetic life insurance policy with ‘extra’ rates.

Now if you aren’t following Doctor’s orders, not taking your insulin as prescribed, then life insurance with Type 1 Diabetes will more expensive to obtain. Companies are going to review your Diabetes medical records, and the last thing they want to see if that you are not compliant in Doctors orders.

Here is an example of how a life insurance company will review two ‘similar’ Type 1 Diabetic health profile:

Male, Non Tobacco user, age 40. Diagnosed Type 1 Diabetic at age 20. His A1C is 7.5, no complications, no other significant health issues and average height and weight.

A 20 year term policy for $250,000 would be about $960 annually.

Compare that to this similar Type 1 Diabetes health profile:

Male, Non Tobacco user, age 40. Diagnosed Type 1 Diabetic at age 20. His A1C is 8.0, no complications, no other significant health issues and average height and weight.

For this person a 20 year term policy for $250,000 would be about $1,200 annually.

That is nearly a $300 difference per year. Over 20 years that’s an extra $6,000 in total premium. If money is a motivating factor for you, working on your Type 1 Diabetes control will be at the top of your priority list.

Your Overall Health Profile

You will hear this time and time again, but what is your overall health profile? Height, Weight, Tobacco user? These are just a few of the questions that will be asked on your Diabetes Type 1 Life Insurance application. Even if your A1C is ideal, but your height / weight is outside of normal range, companies will view you as a higher risk.

Other sample health questions companies will ask for are as follows:

- Any History of Cancer?

- Any history of Heart Attacks, Strokes, TIA, or Stent Placement?

- Any history of Heart, Lung, Kidney, or Liver Disease?

- Any Mental disorders?

- Any Muscular Disorders?

- Any history of Drug or Alcohol abuse?

Your diabetes history is just one part of the overall ‘puzzle’ the companies will review, when you apply for life insurance. The better your overall health, the better chance there may be ‘healthy lifestyle credits’ that can be applied to your profile. These will come in handy when searching for the best priced life insurance policies.

How do I get the Best Rates for Type 1 Diabetes Life Insurance?

Being diagnosed with Type 1 Diabetes is not an end-all when it comes to life insurance. However, if your health condition isn’t maintained, you may find it more difficult to obtain an affordable policy.

Here are a few tips for you, that will help you obtain the best rates possible for life insurance.

Don’t use Tobacco products: Being a tobacco user will make your life insurance rates about 25% to 30% higher. In addition , certain companies may add an extra table rating to your policy.

See an Endocrinologist: NOT ONLY does seeing your Endocrinologist generally help you with your Diabetes control, but some life insurance companies will offer better rates to Type 1 Diabetics who do so. This is a win-win for your health, and for your bank account.

Use Technology: Lots of people are using FitBit and Apple products, that track your movements and activities. But did you know that some life insurance companies will offer discounts, if you allow them to review your data? For some applicants, doing this would be a wise financial move.

Exercise: Another trend we are seeing life insurance companies offer are discounted rates, for those who have a regular exercise routine. Playing sports, walking your neighborhood, working out at the gym are great things to do for your overall health. But to get better rates for life insurance for Type 1 Diabetics this would be a good habit to pick up.

Use Diabetes Related Technology: Again, this is another popular trend. A few life insurance companies are providing better life insurance rates to Type 1 Diabetic’s who use CGM devices.

Be Compliant with Doctor’s Orders: Follow your Doctor’s orders. Plain and simple. IF a Doctor recommends seeing a Cardiologist, or to have a sleep study completed, please do so. If companies see that specific tests haven’t been completed, they may not be able to offer coverage at all.

Underwriters look to see how well you manage your Type 1 Diabetes condition. As long as you are working hard to maintain your health with diabetes, your underwriter can see that. This will benefit you greatly when it comes to obtaining a Type 1 Diabetic life insurance policy.

Diabetes is a lifelong condition that can affect much more than just your need for a life insurance policy. So, it is important to take care of yourself properly. Start a relationship with your doctor and follow his or her guidelines. Learn how to properly handle your health – and score a better rate on your insurance premium.

Does the Amount of Insulin I take Daily Impact my rates?

Yes and No. Some Type 1 Diabetes life insurance companies may rate you higher, or decline you all together depending on the amount of insulin you take. While other life insurance companies are NOT CONCERNED about the number of units, but rather your control of Diabetes. So if you are an individual taking a large amount of Insulin, we’ll want to not recommend companies that will ‘penalize’ you for this.

That’s what makes us different. We will be able to route you to the life insurance companies that are most favorable given your Type 1 Diabetes history. If another agent tells you your policy will be more expensive due to the amount of insulin you take daily, that’s a big red flag that the agent doesn’t work with people with Type 1 Diabetes on a regular basis.

Does the Type of Life Insurance I Apply for Make a difference?

The quick answer is: yes, the type of life insurance policy you apply for will make a difference. Here is why.

Term life insurance is a type of insurance that lasts for a specific time frame. Hence the name, term life. This time frame can be 10 years, 15 years, 20 years, 30 years, etc. The coverage lasts for the length of the term – and the premium remains the same for the entire term duration. However, once the term expires, so does your coverage.

With term life insurance, the longer your term duration, the higher your premium. Diabetes comes with a plethora of potential complications. The longer the length of your policy, the riskier you become – because the chances of you developing a complication increase.

Also, the amount of life insurance you purchase will be a determining factor in premium.

Or if you prefer a non medical exam life insurance policy with diabetes, this could also have an impact on your rates.

We always tell our Diabetes clients that your premiums for Term Life Insurance are determined by:

- Length of Term

- Amount of Life Insurance

- Your Overall Health

Initially, term life insurance will always be less expensive compared to permanent life insurance policies. However, if you wait too long to re-apply for life insurance coverage as you get older, your overall premiums may of been better spent on a permanent policy.

People with Type 1 Diabetes will have options for “permanent” life insurance products. Unlike Term Life Insurance, these permanent products will cover a person’s entire life, with premiums that do not increase.

There are three main types of permanent life insurance products:

- Whole Life Insurance

- Guaranteed Universal Life Insurance

- Indexed Universal Life Insurance

Certain types of permanent life insurance policies can provide cash value growth, in addition to providing life insurance that covers your entire life. Many people who are ideal for Permanent life insurance are people who want life insurance to assist with estate taxes, or maybe leaving an inheritance.

To determine what options are best for you, simply contact us and request a free quote today. Our agents are happy to discuss what type of product is in your best interest.

I have a company in mind. Do I have to shop around?

Yes! When you are seeking life insurance for someone with a medical condition such as diabetes, you are going to want to shop around to find the best policy. Not all insurance companies are created equal. And, neither are underwriters.

Yes! When you are seeking life insurance for someone with a medical condition such as diabetes, you are going to want to shop around to find the best policy. Not all insurance companies are created equal. And, neither are underwriters.

If you work with an agent who isn’t experienced in working with the Type 1 Diabetes community, they may recommend a company that is not in your best interest. This could lead to you paying 25% to 50% more in life insurance premiums. This is never an ideal thing.

You may find that one company will flat out refuse to offer you a policy, another will offer you a generous one, and yet another will offer you a policy but at a very high premium rate. If you are wanting to get the best life insurance policy with Type 1 Diabetes for the best price, you are going to need to get quotes from an agency who ONLY works with Diabetics such as Diabetes 365!

You’ll want to ask the agent you work with how many cases he works for Diabetes Type 1 Life Insurance. Also, to make sure your agent isn’t misleading you, ask for something in writing, from an Underwriter with the life insurance company they are recommending, a breakdown of how your rates are determined.

It’s very easy to receive, in writing, a health profile review from an underwriter. They’ll provide to you the tentative offer, based on health information you shared with them. This may help determine if the agent you are working with is being honest or not.

There are so many companies to choose from, how do I know where to start?

You are correct. There are a ton of life insurance companies out there – all promising you an easy application process and an affordable outcome. Unfortunately, we all know that isn’t always the case. Many online websites provide fake quotes, to Type 1 Diabetics. You apply, and the final rates come back 10 times higher, than what was quoted. Why would you want to experience that? Probably not. That’s why if you want a REAL AND ACCURATE quote for life insurance for Type 1 Diabetics, you’ll need to share your detailed health information with an agent.

Unfortunately, there isn’t JUST ONE company that will be ideal for everybody with Diabetes Type 1. That’s why it’s best to share your health profile with an agent, and let them provide to you your best options.

Applying for coverage can be exhausting and frustrating. The forms are long – requiring you to answer the same questions over and over again. Many have applications and terms that are hard to understand – so you may or may not try applying for something you don’t need or want.

When working with Diabetes 365, you won’t have to worry about receiving fake information. While applying, you’ll only need to do one paramedical exam. We’ll be able to use those ‘lab results’ to share with several life insurance companies. Once we receive your medical records, we will use the relevant information companies need along with your lab results to shop out your health profile.

Once we obtain offers from the individual life insurance carriers, we present to you the options and final rates. At that point in time, you get to choose the type of policy, term length, and amount of life insurance. We have simplified the application process for life insurance with type 1 diabetes.

Why would you subject yourself to all of this?

Your best solution is to hire an independent agent. See, while you continue to live life and do what you need to do, your insurance agent will be finding you the best coverage for the best price. You answer the questions once and then you are done. Your agent will take care of the rest.

It is important to know that insurance agents make it their job to know the companies that are more welcoming to clients with certain conditions, such as diabetes. Using their network, they can save time — as they only need to apply to the companies that will offer the best policy.

Don’t get discouraged. Obtaining life insurance as a Type 1 diabetic is very possible. The better your overall health – and the better maintained your diabetes – the better your chances of obtaining a policy you want. So, start taking care of yourself now. Monitor to A1C levels, work with your doctor to get on a medicinal schedule and eat as you are supposed to. Not only will you find that you feel better, you will also find comfort in knowing you have a life insurance policy, too.

All of this doesn’t have to be too overwhelming for you. Simply contact us, and let us help find you the best policy possible. We make the application process as simple as possible, and provide a first class customer service experience along the way. Don’t let other agents fool you with fake quotes. Work with people who specialize with the Diabetes community!

We have helped 1000’s of people in the Diabetes community obtain affordable life insurance. Let us do the same for you and your family. We are here to help you from start to finish, with your Type 1 Diabetes life insurance application process. Don’t hesitate to use us a life insurance for Type 1 Diabetics resource.