Last Updated on April 17, 2024

You live in the United States. You work hard to provide for your family, but you always have that what if worry in the back of your mind. What if something happens to me? How will my family get by?

You live in the United States. You work hard to provide for your family, but you always have that what if worry in the back of your mind. What if something happens to me? How will my family get by?

It is normal. Many people – protectors – have these thoughts. Typically, it would result in obtaining a life insurance policy to protect your loved ones when you pass on. Life insurance was specifically created to help protect families in the event of a death. But, your situation is slightly different.

You do not have a social security number. You also have a type of Diabetes, which also makes obtaining life insurance difficult.

Along with your name and date of birth, your social security number is a viable piece of information that insurance companies are going to ask you for. So, if you don’t have one, does that mean you can’t get life insurance?

In short, the answer is no. Not having a social security number does not mean you can’t get life insurance. It simply means that you’ll have few options in terms of life insurance companies to choose from. Especially in combination of having Diabetes, and not having a social security number. We are going to dig a bit deeper so you can see how you can take advantage of this incredibly important insurance to protect your family. Diabetes 365 was established to help families with Diabetes learn more about the life insurance options they may have available to them.

Do I Really Have to Have a Social Security Number to Purchase Life Insurance?

Nope. You really don’t. There is nothing in any life insurance manual that states you absolutely must have an SSN to purchase a policy. It is not an industry requirement. Here’s the catch, though. While you don’t have to have a social security number to purchase life insurance, most insurance companies require it. This is similar to how some companies may simply not offer you coverage to having Diabetes.

Nope. You really don’t. There is nothing in any life insurance manual that states you absolutely must have an SSN to purchase a policy. It is not an industry requirement. Here’s the catch, though. While you don’t have to have a social security number to purchase life insurance, most insurance companies require it. This is similar to how some companies may simply not offer you coverage to having Diabetes.

And that is where the problem arises. There are hundreds of life insurance companies to choose from. Each company will have their own guidelines, as to requiring a person to have a social security number. Also, every company will have their own guidelines, as to how they underwrite a person with Diabetes. When you combine not having a SSN and having Diabetes, your options are going to be very limited in terms of companies who may offer coverage.

See, many people in this country try to pull some funny business. And, a social security number tracks nearly everything you do. Good and bad. For instance, check these out:

- Did you know that people use life insurance policies to launder money? See money laundering refers to making money that was obtained illegally appear clean. This is done through a series of legitimate financial transactions. Placing dirty money in life insurance transactions is a common form of money laundering.

- How will the insurance carrier know that you are truly who you say you are if you don’t have a social security number? Identity theft is a huge problem right now – and it does not show any signs of slowing down. Insurance companies want to know you are who you say you are.

- The MIB report is a rather useful piece of information that is used by underwriters to take a look at your medical history. But it is your social security number that links to the report and can ensure the underwriter is accessing the correct report. Without an SSN, there is no confirmation that your information will be documented – or accessed – properly.

- Getting a clear picture of your life, control of your Diabetes, overall health, and how risky you are is important for underwriters. They often discover this information through pharmacy, health/medical records, motor vehicle records, and the like. All of this comes down to your social security number – especially if you have a very common name.

- There is a lot of things that take place behind the scenes by underwriters that allow insurance companies to decide to give you a life insurance policy or not. By requiring a social security number, they can have greater confidence that the information they are seeking is for the applicant. Understand the significance?

Why Don’t You Have a Social Security Number?

There could be several different reasons why you don’t have a social security number. For example, there is a good chance that you are either a non-citizen, a foreign national, or a resident alien.

There could be several different reasons why you don’t have a social security number. For example, there is a good chance that you are either a non-citizen, a foreign national, or a resident alien.

If you are a non-citizen, that usually means you are a citizen of another country. If you are not here illegally, it is possible to get life insurance coverage from your home country – and be covered while you are here.

If this is your situation, you may want to look into this a bit deeper. Also, keep in mind that valid green card holders are able to purchase life insurance without issue.

So, that brings us back to the question: what if you are living in the United States and you intend to live here for a long time, how can you purchase life insurance without an SSN?

Purchasing Life Insurance without a Social Security Number: Get an ITIN

Purchasing Life Insurance without a Social Security Number: Get an ITIN

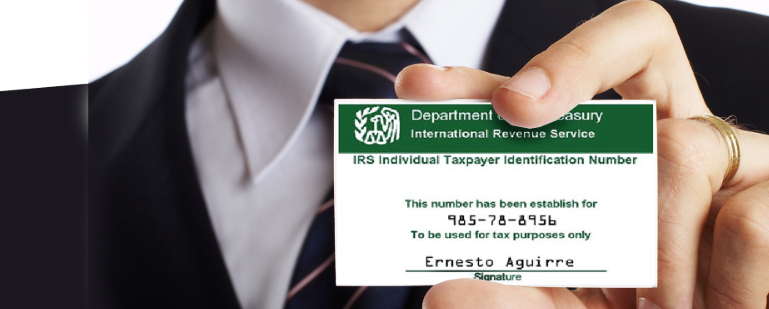

If you currently reside in the United States and your plan is to reside here long-term, it is possible to purchase life insurance to protect your loved ones – even though you don’t have a social security number. In place of this important piece of information, you will need to obtain an ITIN.

Now, you may be wondering: What is an ITIN? How do I obtain one? Relax. We’ve got your answers.

An ITIN stands for Individual Taxpayer’s Identification Number. To receive one, you complete the W-7 form located on the IRS’s website. Then submit it. While these ITIN numbers are typically used for income tax reporting only, it nonetheless gives you a number that solely represents you.

You should be able to receive an ITIN number if you meet the following criteria:

- You are a foreign national or the like who has federal tax reporting or filing requirements, but you do not qualify for a social security number.

- You are a non-resident alien who is not eligible for a social security number, but you are required to file a U.S. tax return only to claim a refund of tax under the provisions of a U.S. tax treaty.

- You are a non-resident alien who is required to file a U.S. tax return.

- You are a U.S. resident alien (based on days present in the U.S.) and you need to file a U.S. tax return.

- You are a dependent or spouse of a U.S. citizen or resident alien.

- You are a dependent or spouse of a non-resident alien visa holder.

I’ve Got My ITIN, Now What?

Once you have your ITIN, you can move forward with applying for life insurance. It is important to keep in mind, however, that not all life insurance companies accept an ITIN number instead of a social security number.

This is where it is important to consult with an independent agent from Diabetes 365.. See, this is our expertise. We know which companies accept ITINs and which don’t. Most importantly, we also specialize in working with the Diabetes community, obtain life insurance.

We also know which ones have a more simplified process and which ones are more likely to provide you with a policy to meet your needs at a price you can afford. This is what we do.

After getting in touch with an agent, we’ll have an initial consultation. Here are some sample questions we’ll ask, to get a better idea of your situation:

- What is you age of Diabetes onset?

- Do you have Type 1, or Type 2 Diabetes?

- What types of medications are you taking for your Diabetes?

- What is your average A1C reading?

- Do you have any Diabetes consultations such as retinopathy, or neuropathy?

- Have you ever been declined life insurance due to Diabetes?

- Do you prefer a no medical exam policy ?

- Are you in need of Term Life Insurance, or Whole Life Insurance ?

The answers to questions like these, will help us determine what life insurance companies may offer you coverage. In most situations, options may be limited for you. We’ll do our best to secure you as many options as possible. Again, options may be limited for you. We’ll do our best to secure you as many options as possible.

Again, we want to reiterate that having an ITIN will eliminate coverage options with several life insurance providers. This, along with having Diabetes is really going to limit the number of companies you can choose from. We understand this can be frustrating, but we always want to be honest with consumers.

When you work with an agent from Diabetes 365, you’re going to receive a first class experience. Your assigned agent will work with you, and will always provide real and accurate information to you. We’ll make the life insurance application process as seamless as possible.

While applying, your agent will stay in touch with you, so you always know where your application stands, with the Underwriter. Using your unique situation and Diabetes history, we’ll help you navigate the life insurance marketplace.

If you are ready to purchase your life insurance policy but don’t know where to start, reach out to us today. We are here to help you and your family, with all your life insurance needs.