Last Updated on April 24, 2024

Diabetes is more common than you think. According to NIDDK , here are the latest statistics:

- Total: An estimated 30.3 million people have diabetes (9.4 percent of the U.S. population)

- Diagnosed: An estimated 23.1 million people have been diagnosed with diabetes (7.2 percent of the U.S. population)

- Undiagnosed: An estimated 7.2 million adults, ages 18 years or older are undiagnosed (23.8 percent of people with diabetes)

Purchasing term life insurance for diabetics may not be as easy as you originally thought. You always hear those commercials saying that you can get $500,000 of term life insurance, for $23 dollars per month. Sounds great, doesn’t it???

But did you know if you have Diabetes, either Type 1 or Type 2, you won’t qualify for those low, low rates. Or you may be declined all together for those products that are being advertised on TV and the Radio. Sadly, those companies don’t disclose up front, that Diabetics will not qualify for those lower priced policies.

Life insurance comes in two forms. Permanent, and Term. Term life insurance for diabetics can be an affordable alternative to traditional permanent life insurance policies, for the people who will not need life insurance for their entire life.

Diabetes term life insurance policies offer lower premiums for individuals with diabetes who cannot afford or who do not need whole life insurance coverage. It is important to weigh the risks and benefits of each type of life insurance policy prior to purchasing as each has their respective pros and cons.

What is Term Life Insurance?

Term life insurance is a life insurance policy that is secured for a specific period of time. Should the policy holder pass within the time period that the term life insurance policy was active, death benefits would be paid to the beneficiary. However, if the term expires, the coverage is void and no payout will be available upon the death of the policy holder. This is very straightforward, and easy to understand.

Common terms of coverage are often secured for 10, 15, 20, 25 or 30 years (duration of terms vary based on your needs). As is with any life insurance premium, you pay a monthly premium. Term life insurance policies tend to have much lower premiums initially as opposed to permanent life insurance, making term life insurance a more affordable choice for diabetics.

The downfall to term life insurance is that there is no guarantee that you will be able to obtain a new policy when the term expires, leaving your death benefit payout dependent on your ability to obtain a new policy if you do not pass within the term of your policy. You never know what your overall health, and control of Diabetes will be, at the time of your next life insurance application.

Some companies allow you to convert part, or all of your policy during your initial term period. Generally, a life insurance company will not require you to complete any further underwriting, or health exams. They simply will determine your premium at time of conversion based off current age, and amount of insurance converting.

What Term Life Insurance is Not

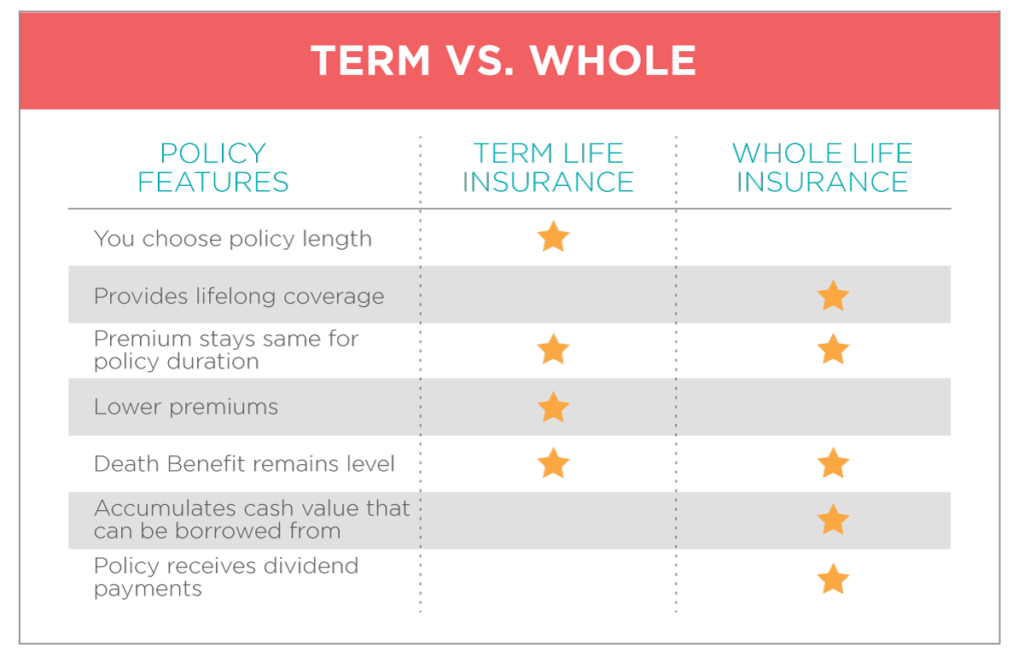

Term life insurance is not a form of permanent or whole life insurance. Whole life insurance policies provide life insurance coverage for the entire duration of the policy holder’s life as long as the premiums are paid in full. Whole life insurance policies also boast the benefit of accumulating cash value – a benefit not present with term life policies. Diabetic term life insurance will only provide coverage, for the term duration, or durations you choose as the policy holder.

While whole life insurance policies are highly desirable for their duration of coverage and extensive benefits, monthly premiums associated with whole life policies are much higher than premiums associated with term life policies. Many people with Diabetes will not be able to afford the higher premiums for $250,000, $500,000 or $1,000,000 in life insurance you’ll need to protect your family.

For diabetics, already high premiums will be even greater, making whole life policies difficult to afford for diabetics on a limited income. Both term life insurance and whole life insurance will have premiums that do not increase for the term duration of the policy. The following chart breaks down the differences between Term and Whole life insurance.

Can I Qualify for Term Life Insurance with Diabetes?

Without knowing a person’s complete health profile, or their Diabetes history, it’s impossible to say. But for the majority of Type 1 Diabetics, and Type 2 Diabetics, there are generally a plethora of term life insurance options available.

Term life insurance rates for Diabetics are currently at an all time low. Overtime, life insurance companies have changed their underwriting guidelines, and begun viewing people with Diabetes a little more favorably, then they have in the pasat.

Ultimately, a person’s complete medical history will determine if they qualify for coverage, and at what rates. To determine what your options are simply contact us, and let us share what policies you may qualify for.

What do Term Life Insurance Companies look for in my Diabetes History?

First off, all diabetic life insurance companies will have different underwriting guidelines for diabetics. NO two companies are the same!

Diabetes information life insurance companies will consider:

- Your type of diabetes

- Age you were first diagnosed with Diabetes

- Most recent A1C reading

- Any use of Diabetes related technology

- Any diabetes-related complications

- How often do you test your Blood Sugar

- Types of Diabetes medications being used

- How often do you see your Doctor or endocrinologist

- Do your watch your Diet, and exercise regularly

This list will give you an idea of the Diabetes information a life insurance company will be looking for, when applying for term life insurance coverage. Our agents will work with you to help you gather everything you would need before hand. If you have Type 2 Diabetes, here’s an article that provides some tips in getting the best possible premiums.

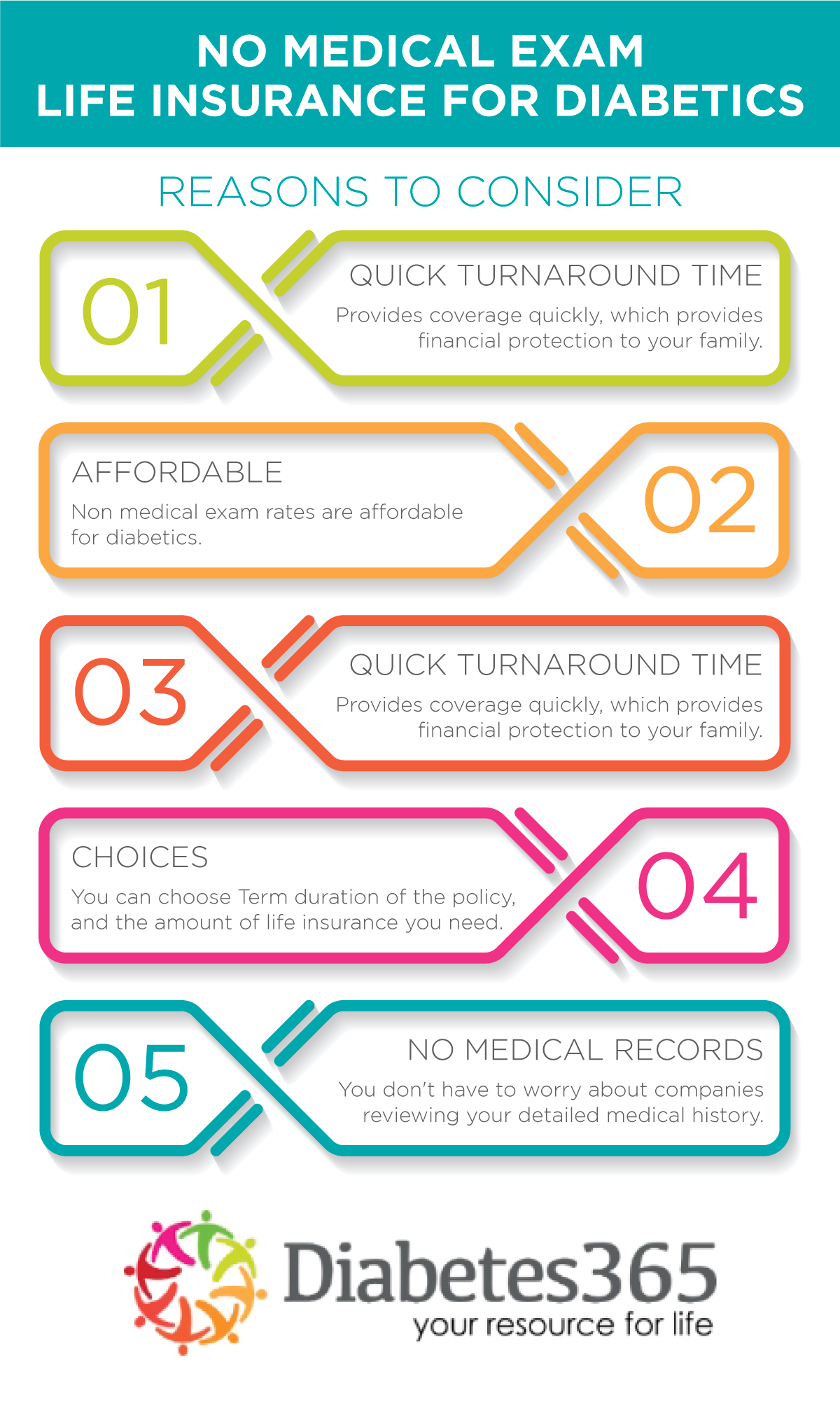

Can I get a Term Life Insurance Policy with Diabetes without doing an Exam?

Fortunately for the Diabetes community, more and more life insurance companies are beginning to offer this option. Type 1 and Type 2 Diabetics may have multiple options for non medical exam life insurance policies.

Some carriers will be able to make an underwriting decision in a matter of minutes, or days. The life insurance company will have you answer health questions, provide details to your Diabetes and other health history. They will also do a MIB ( Medical Information Bureau) report, and will run a prescription background check. That information will provide them with enough information to either approve, or deny you for Term Life Insurance.

Other non medical exam policies may require a review of medical records. IF that’s the case, an approval may take up to three or four weeks. Once the medical records are received, the Underwriter will review your Diabetes history and will be able to make an offer. Depending on your complete health history, this may or may not be the best way to move forward with a term life insurance policy.

To determine what your specific options for non medical exam life insurance for diabetics are, simply reach out to us. An agent would take down some basic health information, and could then provide all the various options to you.

Does Having Diabetes make my Term Life Insurance Policy more Expensive?

Possibly. There are so many factors that go into determining the rates for term life insurance, for diabetics. It’s impossible to accurately say YES or NO without knowing more about you and your health.

If you have Type 1 Diabetes, most likely your rates will be higher compared to a person with Type 2 Diabetes, or without Diabetes. Majority of life insurance companies still view the Type 1 Diabetes community as a higher risk. Thus, they will ‘table rate’ our policy, which means you’re premiums will be more expensive.

People with Type 2 Diabetes will usually find their term life insurance rates better priced, and often times will receive rates similar to those without Diabetes. Due to Type 2 Diabetes becoming more common, life insurance companies have gotten smarter, and are offering better rates.

To see what possible rates you may qualify for, reach out to us. We love to help people with Diabetes find the best possible life insurance policies

What Term Durations of Life Insurance are Available?

Since everyone has different financial objectives, there isn’t any ‘one size fits all’ policy that is perfect for everyone. Because of this, life insurance companies will provide different term lengths to accommodate.

Majority of term life insurance providers will offer durations of 10 years, 15 years, 20 years, 30, years, or even 35 year term periods. So if you are wanting to protect a mortgage with life insurance for 30 years, you could do so. Or possibly you have a need for a SBA Loan that requires a life insurance policy to be assigned for 10 years, you could most certainly do that.

Everyone’s personal situation is different. Term Life Insurance policies can be customized to your needs. IN certain situations, it may make sense to ‘ladder’ multiple term policies together. As you get older and the need for coverage decreases, one term policy would expire, but another one would already be in place, to STILL provide the protection you need.

What ‘Riders’ does a Term Life Insurance Policy Come With?

Great news! Even though you have Diabetes, your term life insurance policy can come with the same types of Riders, that non diabetics policies come with. Here are some popular riders our Diabetic clients tend to take out on their policies.

Popular Riders

+ Living Benefit Riders – If diagnosed with a Terminal Illness, Chronic Illness, or Critical Illness, you could accelerate part of your death benefit while living.

+ Waiver of Premium Rider – A waiver of premium rider pays all life insurance premiums due if the insured person becomes disabled.

+ Guaranteed Insurability Rider – This rider lets you purchase additional life insurance coverage at a later date without undergoing a medical exam or providing any evidence about your insurability.

+ Return of Premium Rider – If you live to the end of the term, in exchange for paying the premium, in most circumstances you get all your premiums back.

Our agents are happy to explain the Pros and Cons, of these riders. Some of the riders may cost extra, while some may free and built into the policy at no cost.

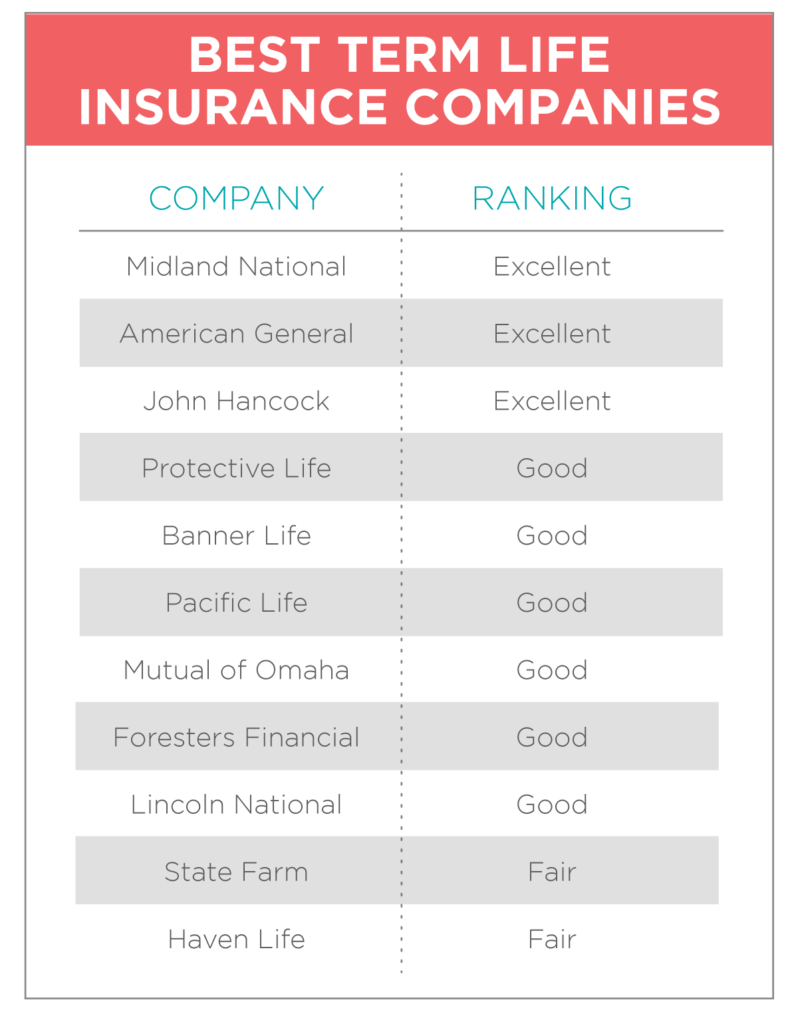

What Term Life Insurance Companies are Best for Diabetics?

As a person with Diabetes, you will have options in regards to the life insurance companies, who will offer diabetic term life insurance policies.

Your Diabetes and health history will determine what companies, and what rates will be available to you. We generally recommend for a person to allow us to run their health profile past various insurance carriers, and then let us present to you the various offers.

Company A may review your health profile, and make an offer that is 25% higher than Company B. This is why we recommend you ONLY work with life insurance agents, such as Diabetes 365, who specialize in working with the Diabetes community.

If wanting to undergo a ‘fully underwritten’ policy take a look at in our opinion the best Term Life Insurance Companies for Diabetics.

What is the Application Process?

Once you’ve decided on a non-mendical exam policy, or a policy that requires Blood work and a review of medical records, you simply contact an agency such as Diabetes 365.

We would provide the application to you to complete, or you could complete it over the phone and thru email with one of our agents. The choice is simply yours.

While you application for term life insurance is pending, your agent would stay in contact with you. If any additional information is needed by the life insurance company, we would simply reach out to you.

Our agents would also help you prepare for your medical exam, if needed, and would work with your Doctors office on obtaining the necessary medical records. Once all information is received, and the life insurance company made their offers, our agents would present to you your various term life insurance for Diabetics options.

At that point you can choose the insurance company, term length, and amount of coverage. Your policy is then emailed or mailed to your address. The entire process is much simpler, then you probably realize.

Who Should Consider a Term Life Insurance Policy?

It is important to consider all of your life insurance options, as well as the pros and cons associated with the policy you plan to pursue. Searching for term life insurance for diabetics isn’t as easy as you think. Lots of online websites provide FAKE quotes, to trick you into applying for coverage through them. At the end of the process, your rates comes back much, much higher. This isn’t the way to go about treating the Diabetes community!!! Term Life Insurance for Diabetics is a good option if any of the following apply to your personal situation:

- You are young, and need the lowest priced life insurance option

- Only need life insurance for a specific term period

- Need a policy for a shorter duration, to possibly cover a SBA Loan or a Divorce decree.

- You are unsure if you need a permanent policy at the moment. You can always convert to a permanent policy in the future

Discuss your needs with an independent life insurance agent to assess the extent of coverage you need. It’s our job to work with you, and to help you and your family make the best decision possible. Don’t put this important decision off any longer. Contact us and let us go to work for you!